Holdings

Historical returns

Inception

Investment outcomes below are real and based on actual account(s). Results are from 01/01/2016 to 03/31/2024 and for “Aggressive” investment style; clients with “Moderate” or “Conservative” investment styles would have experienced lower returns. In full disclosure of effects of material market and economic conditions on returns, S&P 500 Index returns are included. All performance results are net of fees, dividends/reinvestments, and other adjustments. Past performance does not guarantee future results. Investing carries substantial risk including loss of principal.

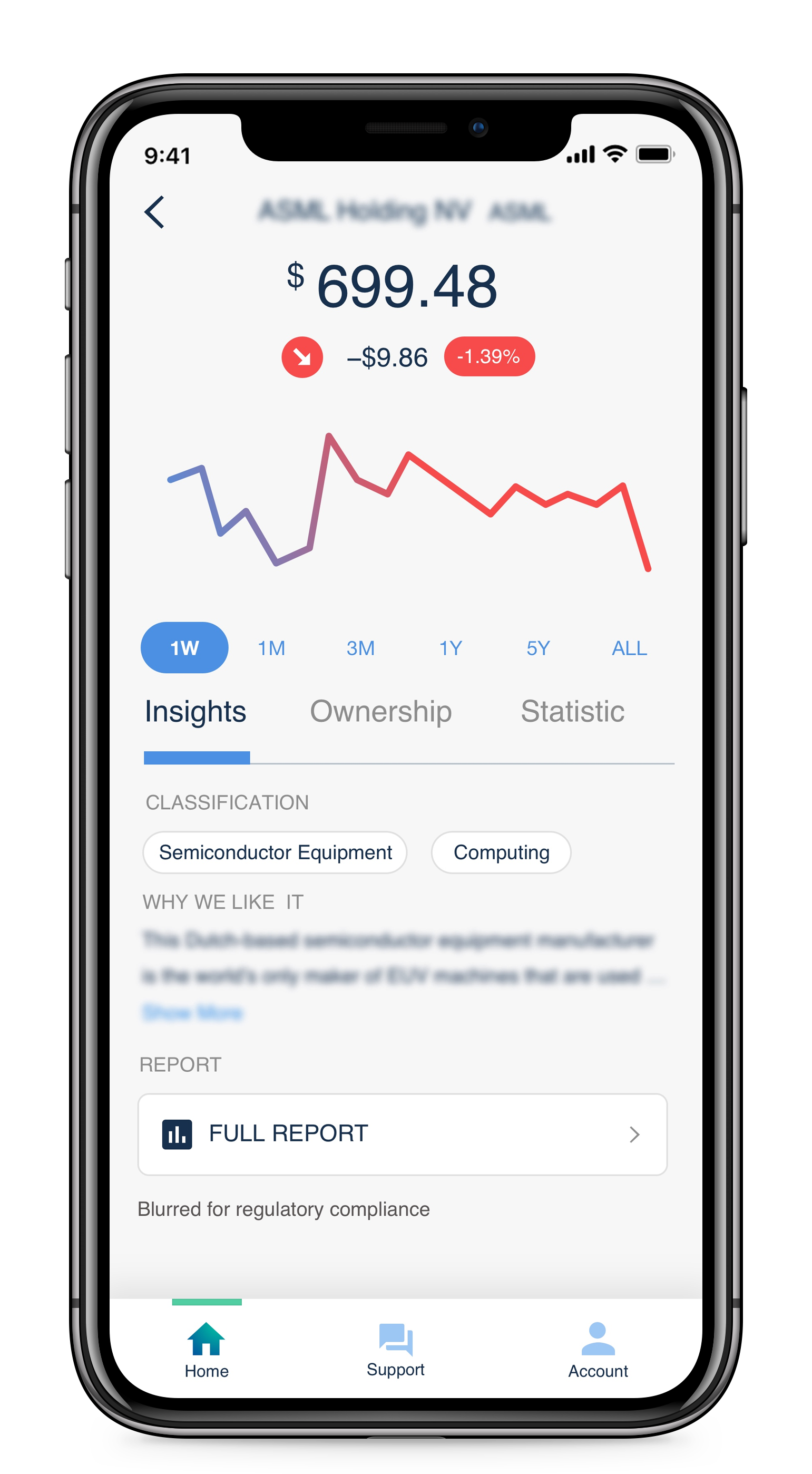

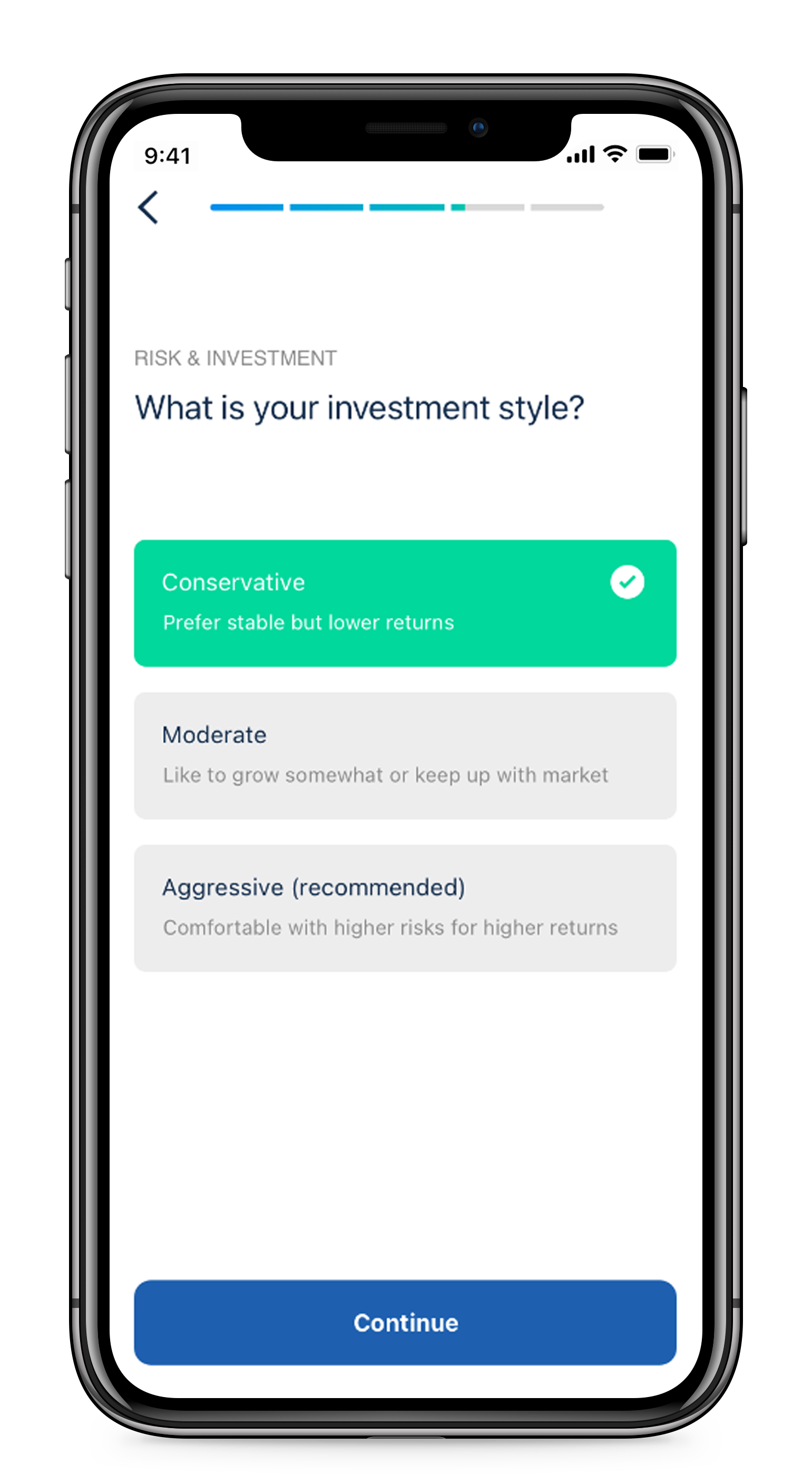

Premium experience We don’t just manage your investments, we help you learn along the way!

Easy to use

Quickly onboard and set up an account in under 5 minutes.

Low minimum and fractional trading support means you can get in the game.

Account Protection

We are SEC-registered and all accounts are separately managed with up to $500,000 in SIPC insurance.

No lock-in either: cancel and close your account anytime.